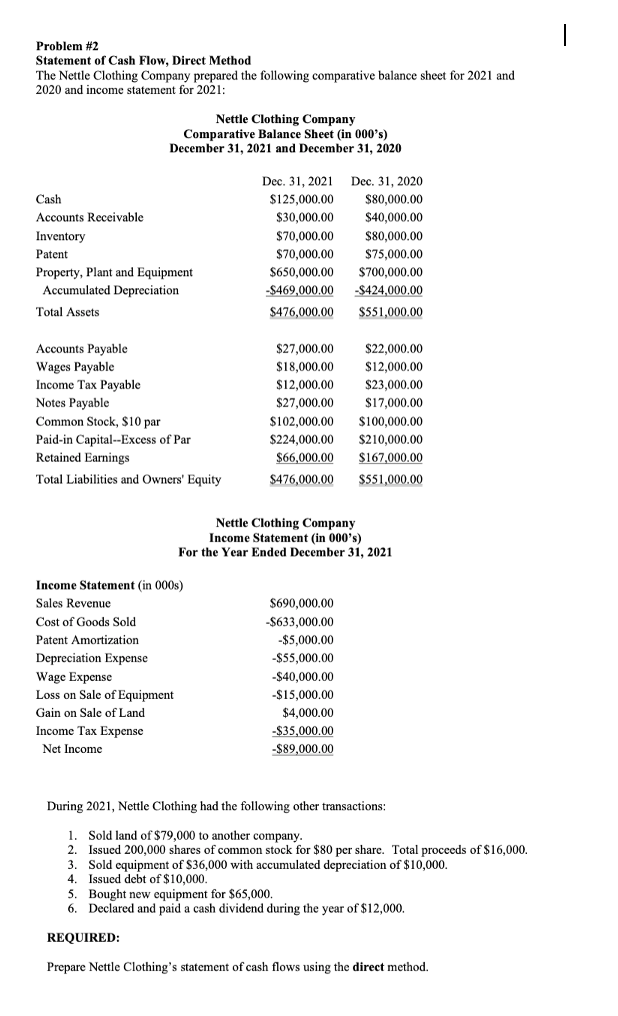

Clothing depreciation life ~ 3 Suits Sportcoats Slacks etc. The balance of depreciation the remaining 50 is written off in the year after the last class life year of the property. Indeed recently is being hunted by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the net in gadgets to see video and image data for inspiration, and according to the name of this post I will discuss about Clothing Depreciation Life Clothing - Mens - Jeans Depreciation Rate.

Source Image @ slideplayer.com

Accounting 3 Chapter 21 Section 5 Declining Balance Method Of Depreciation Declining Balance Method Of Depreciation Multiplying The Book Value Of Ppt Download

By taking the amount of depreciation and dividing it by its five year life span youll take 1800 of depreciation each year for the five years its usable. For buildings depreciation will reduce to 0 from the 2011-12 income year where they have an estimated useful life of 50 years or more. Your Clothing depreciation life images are ready. Clothing depreciation life are a topic that has been searched for and liked by netizens today. You can Find and Download or bookmark the Clothing depreciation life files here

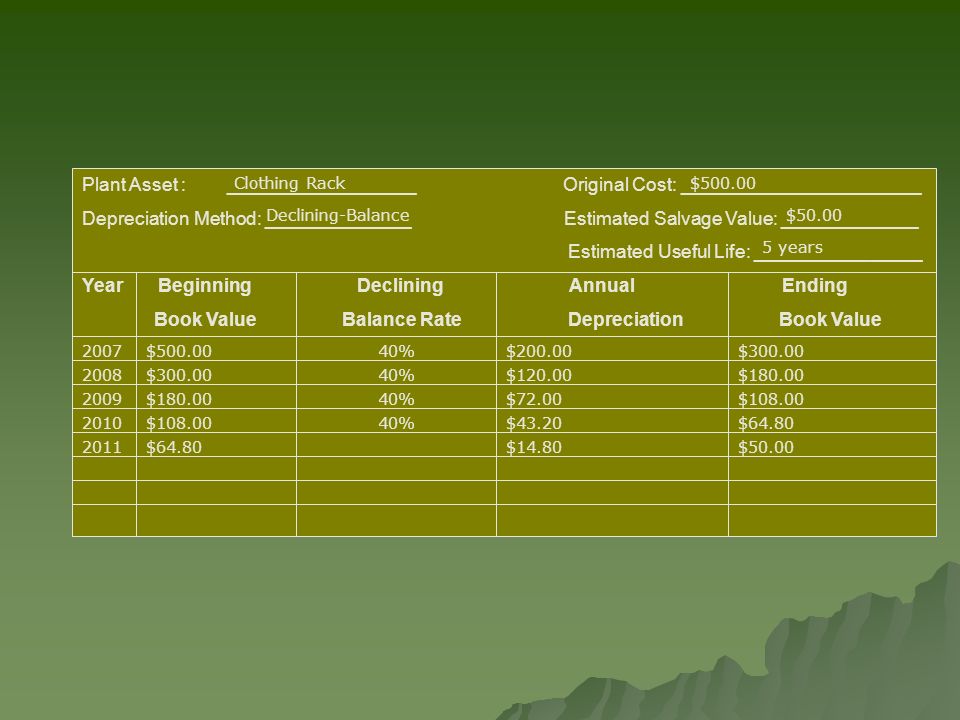

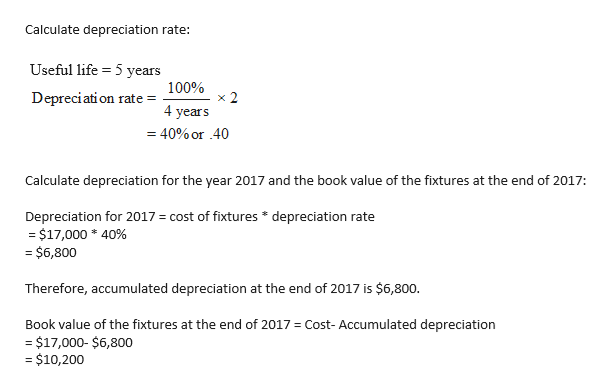

Clothing depreciation life - 100 5 years 20 and 20 x 2 40. There are two main methods used in the UK to calculate depreciation the straight-line method and reducing balance method. Depreciation limits on business vehicles. This implies a recovery period of 5 years for regular depreciation MACRS and a recovery period of 9 years under the Alternative Depreciation System ADS.

If you hand wash add some. This is the first of two accelerated depreciation methods that are commonly used. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2020 is 18100 if the special depreciation allowance applies or 10100 if the special depreciation allowance does not apply. 4 Blouses Shoes Nightclothes 3 Lingerie 2 Concrete Concrete Balcony Slabs 10.

10000 per year Keywords. If you tumble dry take 25-50 off those numbers. Laundry assets in guestrooms. The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674.

Each plant and equipment asset has an effective life set by the Australian Taxation Office ATO. That is if you line dry and machine wash. Effective Life Diminishing Value Rate Prime Cost Rate Date of Application. Clothes lasts about 100-200 wash cycles allowing the computation of daily depreciation costs mostly for fun.

955 x 10000 500 1555. The 20 depreciation loading doesnt apply to assets acquired after 20 May 2010. Divide the depreciable base by the number of years in the expected lifespan of the machine to calculate each years depreciation. Plant and equipment assets including removable or mechanical assets are also eligible for depreciation deductions.

Also note that under the half-year convention if the property is sold only one-half of the full depreciation for that year is deductible. The depreciation rate you need will be based on the type of asset and how long it will be used useful life. 43 Effective Life Years Date of Effect Water filters. That is if you line dry and machine wash.

The length of time that an asset has useful life depends on its class for depreciation purposes. Clothing - Children Jackets Coats 3 Shoes 2 All Other 1 Clothing - Men Overcoats Topcoats Raincoats 5 Shirts Pajamas Shoes Socks etc. The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the IRC or the alternative depreciation system provided in section 168 g. Here are the steps you need to take to depreciate your fixed assets.

So for your first year youll write off 1727. Clothing childrens clothes attire shoes nike converse running formal work new balance puma reebok DEPRECIATION FORMULA. Clothing - Childrens - Shoes Depreciation Rate. Clothes peg manufacturing plant wood 13.

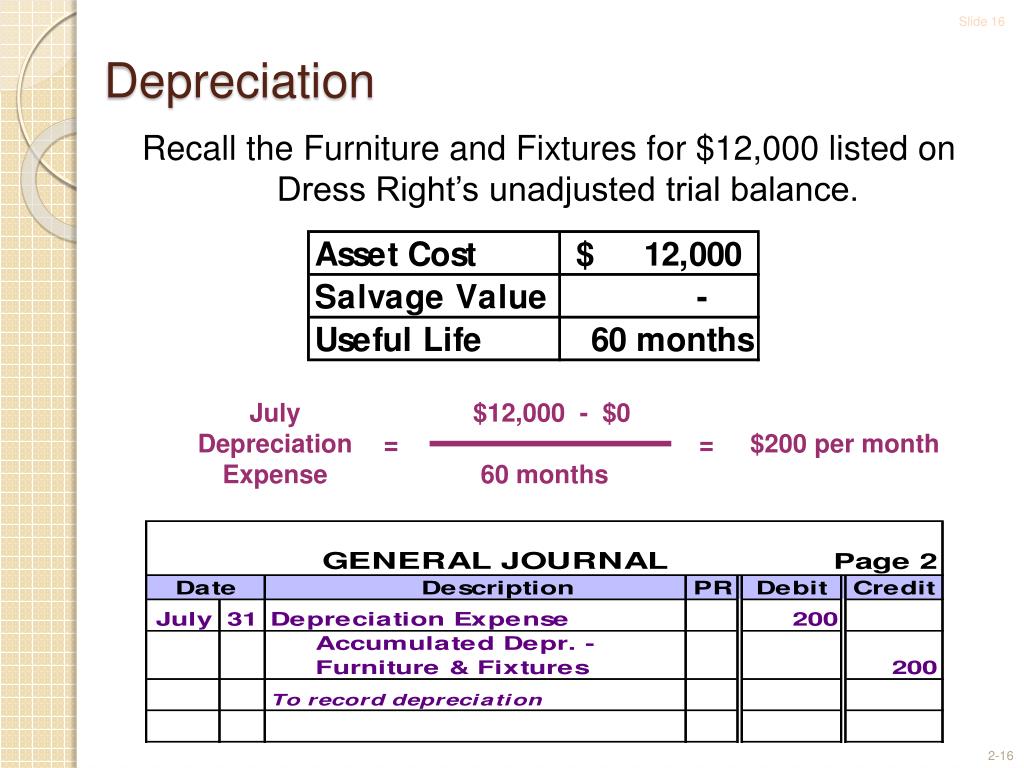

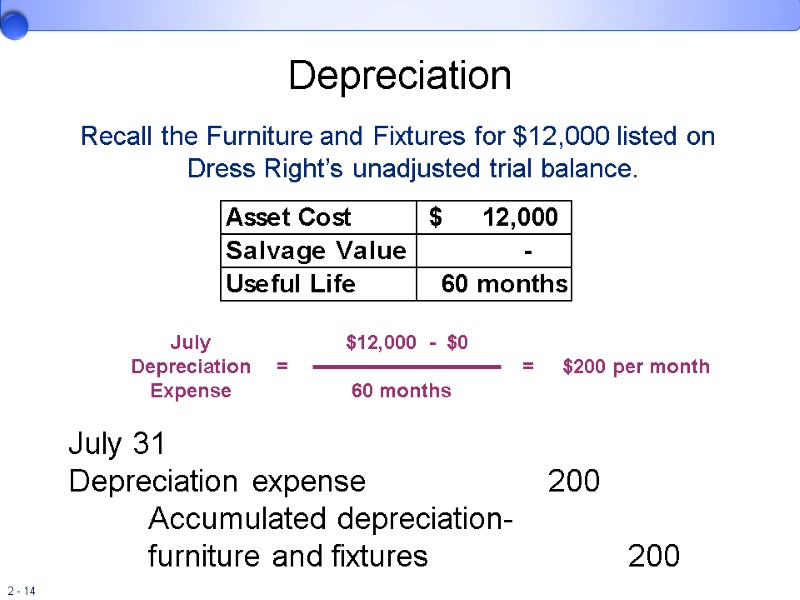

For Example consider a straight-line method of depreciation Furniture purchased for 11000 having a useful life of 10 years and can be sold at the end of its useful life for 1000. As a general rule of thumb these toys will go down in value by 20 in the first year and then 15 every year after that until the 10 year mark. After 5 years depreciation goes down 63. Some common ones include a three-year lifespan for tractors and livestock a seven-year lifespan for office furniture and a 39-year lifespan for commercial buildings.

Electrically operated units 15 172004 Other plumbed-in units Laundry Assets Clothes chutes Clothes dryers 10 172004 Irons 5 172004 Ironing boards. The current class life of assets in Asset Class 570 is 9 years. Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance. Step 6 Multiply the yearly depreciation value that you calculated in the previous step by the number of years the machine has been used.

The depreciation available on. 40 Building Write-off Div. 4 Clothing - Women Fur Coats Jackets 15 Cloth Coats Dresses Gowns Suits Etc. If you tumble dry take 25-50 off those numbers.

An item that is still in use and functional for its intended purpose should not be depreciated beyond 90. Remember the factory equipment is expected to last five years so this is how your calculations would look. Divide 100 by the number of years in the asset life and then multiply by 2 to find the depreciation rate. Jeans denim pants dungarees levis wrangler clothing denims.

11 depreciation minutes after the purchase. From the 2011-12 income year depreciation on buildings has reduced to 0 where buildings have an. The value dives by 46 after just 3 years. ACCOMMODATION AND FOOD SERVICES.

Other wood product manufacturing. Clothes lasts about 100-200 wash cycles allowing the computation of daily depreciation costs mostly for fun. Lose 20-25 by the end of year 1. Keep in mind each year the bouncy castles remaining lifespan is reduced by one So in your second year of depreciation your equation will look like this.

Work out UK Depreciation Rate. The IRS sets these limits. Use this table to determine an assets class based on. Here for calculating depreciation we need to determine depreciable value by reducing scrap sale value ie 11000 1000 which is 10000 and this amount will be split in between 10 years equally.

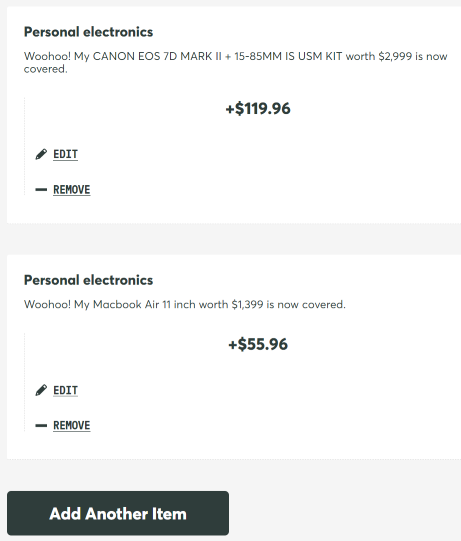

Source Image @ www.insider.com

Source Image @ www.travelinsurancedirect.com.au

Source Image @ www.slideserve.com

Source Image @ slidetodoc.com

Source Image @ slidetodoc.com

Source Image @ www.bartleby.com

Source Image @ www.chegg.com

Source Image @ www.chegg.com

Source Image @ present5.com

If you re looking for Clothing Depreciation Life you've come to the right place. We ve got 10 graphics about clothing depreciation life including images, photos, pictures, backgrounds, and more. In these web page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, symbol, black and white, transparent, etc.

If the publishing of this web page is beneficial to your suport by revealing article posts of the site to social media marketing accounts that you have such as Facebook, Instagram and others or may also bookmark this blog page using the title Review Of The Accounting Process 2 Copyright C Work with Ctrl + D for laptop devices with Home windows operating system or Command word + D for personal computer devices with operating system from Apple. If you are using a smartphone, you can also use the drawer menu with the browser you use. Be it a Windows, Mac, iOs or Android os operating system, you'll still be able to download images utilizing the download button.

0 comments: