Can you deduct clothing for business expense ~ If youre working for someone else then your clothing expenses would go on your form 2106 Employee Business Expenses. You can claim this promotional cost as a miscellaneous deduction on your tax return. Indeed recently has been hunted by users around us, maybe one of you. Individuals are now accustomed to using the net in gadgets to see image and video information for inspiration, and according to the title of this article I will talk about about Can You Deduct Clothing For Business Expense You cannot claim for.

Source Image @ www.kpmgspark.com

Can I Deduct My Clothing As A Business Expense Kpmg Spark

Any clothes youre trying to claim as a business deduction have to be ordinary and necessary expenses. You can generally deduct the cost of clothing you use in your business if the clothes could be considered an ordinary and necessary business expense and are not suitable for everyday wear. Your Can you deduct clothing for business expense photos are available. Can you deduct clothing for business expense are a topic that has been hunted for and liked by netizens today. You can Find and Download or bookmark the Can you deduct clothing for business expense files here

Can you deduct clothing for business expense - If the expense does in fact qualify as a distinctive uniform eg. If youre a writer who works from home for example chances are you wont be able to deduct any clothing. You dont wear the. If you purchase something for your business that has a useful life of over one yearlike a costume or an instrumentthen youd record it as a business asset and deduct a portion of the expense over multiple years.

You must wear them as a condition. Its true that you can deduct the amount you spent on the purchase and upkeep of work clothes but your clothing must meet two requirements before you can claim the costs as an other expense on the Schedule C tax form where you report self-employment income and expenses. To claim a deduction for buying clothes the clothes have to be mandatory for your job and unsuitable for everyday wear. You Can Deduct Clothing and Laundry ExpensesLegally.

Now if the shoes are made of some special clay court-gripping material and youll only ever wear them while teaching tennis then maybe they count. I would be remiss to not at least mention highly specialized clothing such as costumes wigs or even make-up skincare products or haircare are deductible if suitable for only. If you can meet EACH of the 3 tests above your in the money and your clothing would be deductible as a ordinary expense in your business. If youre self-employed these expenses go right onto your Schedule C and its a direct offset against your income.

However the category you should use depends on. Most of us dont wear the same thing we wear on the weekend or out to dinner at night as office apparel. You cannot deduct the cost of the clothing because they can theoretically be worn for other purposes than that business like going to the gym on your own time. Many different types of businesses use Amazon to source supplies.

If youre in a job that requires protective gear I count the gear as a deductible business expense. Nevertheless every once in a while a taxpayer is adamant that the cost of his or her clothing should qualify for a tax writeoff and takes the matter all the way to court. It is essential for your business. For example if youre a musician this would include your.

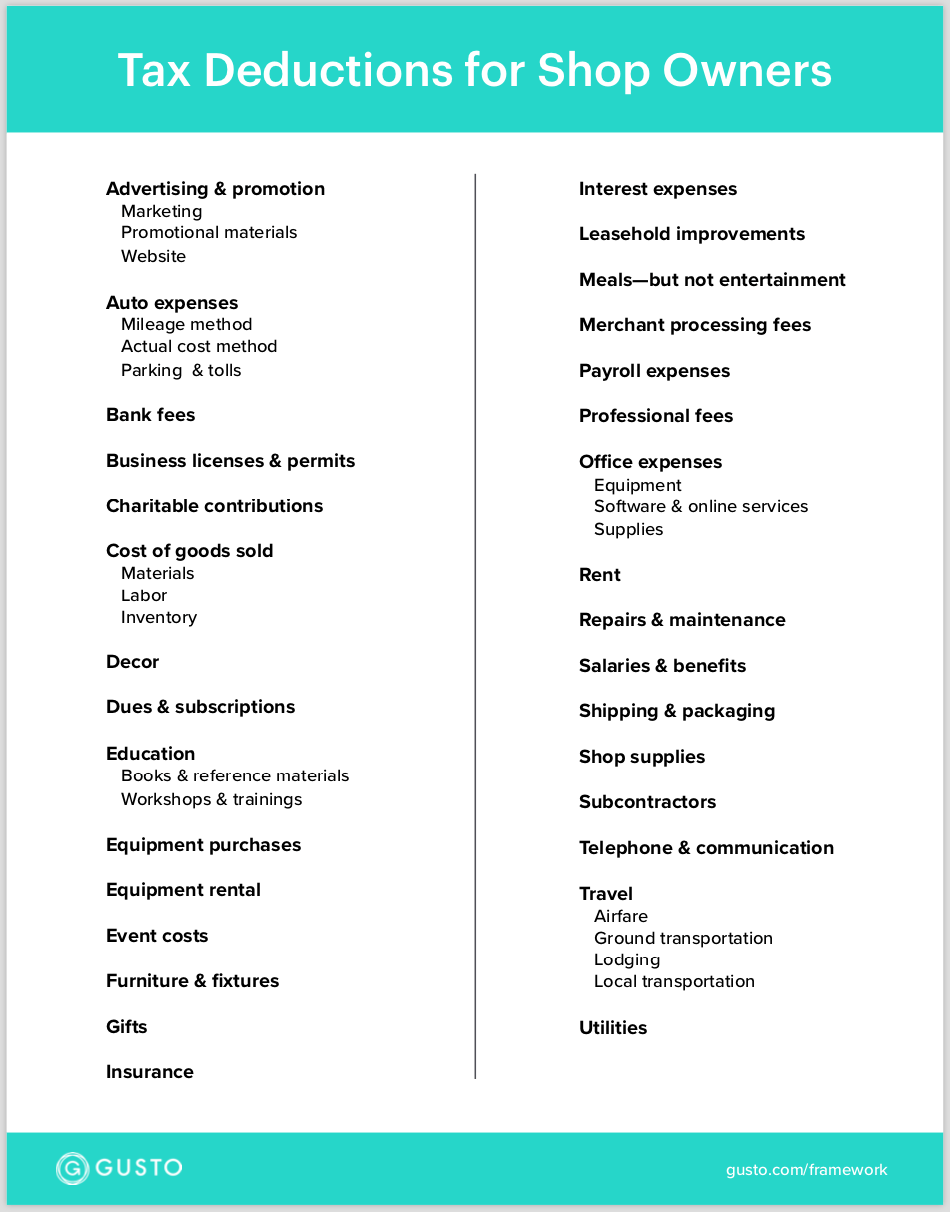

This includes the cost of the clothing itself and the cost of adding your business logo to the item. You can claim allowable business expenses for. Costumes for actors or entertainers. There are two requirements that youll need to satisfy before you can take a deduction for business clothing purchases.

In fact the IRS allows tax. Costumes Wigs and Make Up. Clothing that promotes your business is deductible as a promotional expense. Coveralls with your companys logo or a hazmat suit chances are that you will not be wearing that to anything else except perhaps as a somewhat unimaginative Halloween costume then you are allowed to deduct the total amount incurred.

Business-expense deductions are not allowed for clothing described as professional or business attire such as business suits. However the IRS does have guidelines for what clothes can be deducted. That means its normal for taxpayers in your line of work to claim them and theyre necessary for you to do your job. Can I deduct my Amazon Prime subscription.

Since youre likely spending extra money to have appropriate clothing to wear to work it makes sense that you can count it as a business expense. Equipment you purchase to run your business is deductible. In almost all instances you will be able to claim the cost of the clothing as a deductible business expense. If your job requires you to wear a uniform and that uniform is not suitable for everyday wear you may be able to deduct the cost of the clothing as a business expense.

Not necessarily according to the Internal Revenue Service IRS. The rule is that you can deduct the cost of clothing as a business expense only if. Can I deduct Clothes as a Business Expense. Clothing is generally not a tax-deductible expense.

It is not suitable for ordinary street wear. Protective clothing needed for your work. If you determine your clothing to be deductible you will also be able to deduct the cost of any incidental expenses associated with your work clothing. Work clothes that can double as street or evening clothes are no more deductible than anything else in your closet.

Source Image @ gusto.com

Source Image @ amynorthardcpa.com

Source Image @ bench.co

Source Image @ www.keepertax.com

Source Image @ www.inniaccounts.co.uk

Source Image @ www.sweetercpa.com

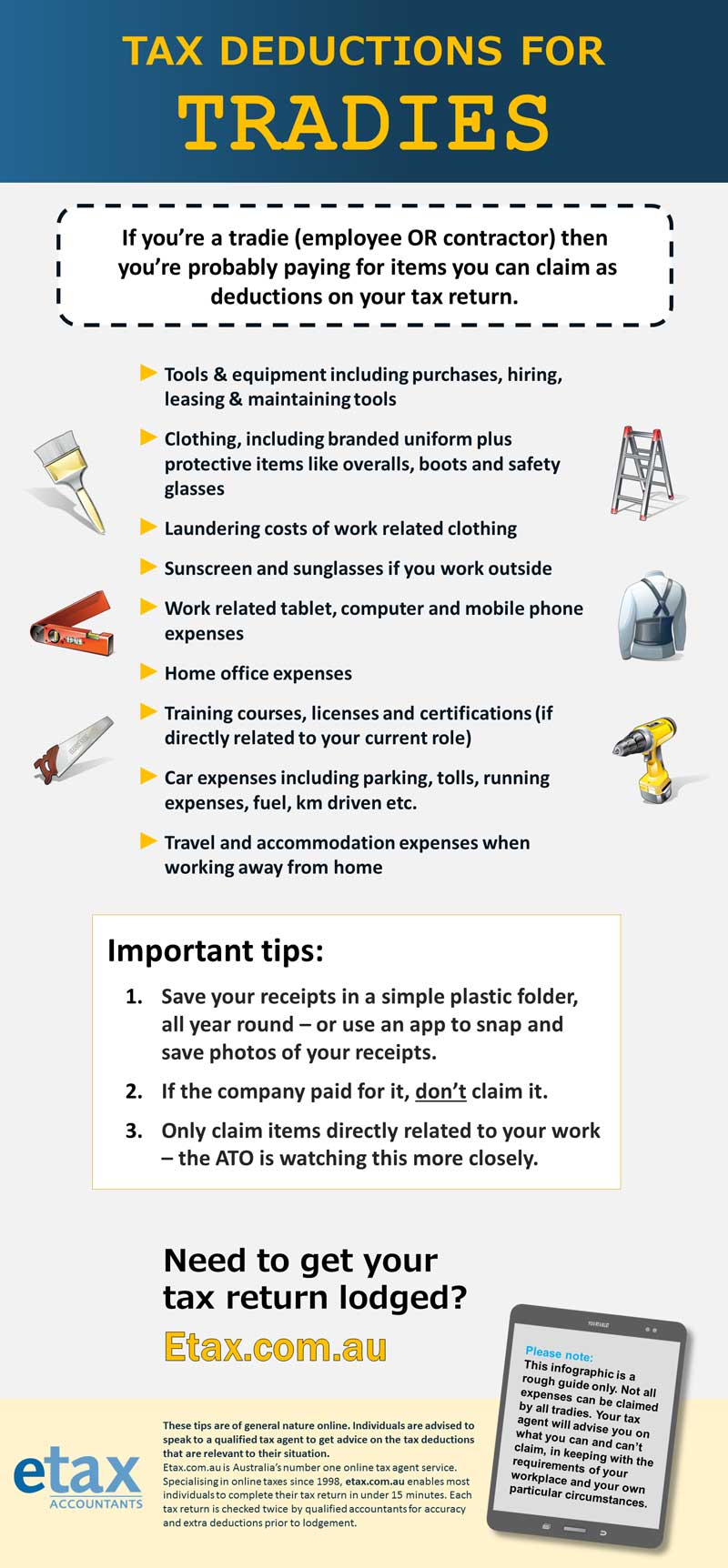

Source Image @ www.etax.com.au

Source Image @ www.investopedia.com

Source Image @ thecollegeinvestor.com

If you re looking for Can You Deduct Clothing For Business Expense you've arrived at the right location. We have 10 graphics about can you deduct clothing for business expense including images, photos, pictures, wallpapers, and much more. In such webpage, we also provide number of graphics out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

If the posting of this site is beneficial to our suport by sharing article posts of the site to social media marketing accounts as such as for example Facebook, Instagram and others or can also bookmark this blog page together with the title Tax Deductions For Your Online Business Expenses Work with Ctrl + D for pc devices with House windows operating system or Control + D for computer system devices with operating-system from Apple. If you use a smartphone, you can even utilize the drawer menu in the browser you utilize. Whether its a Windows, Apple pc, iOs or Android os operating system, you'll still be able to download images utilizing the download button.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 comments: